Recently, HeveaBoard Bhd's 2Q19 financial result just released and recalled me something related to 1Q19 quarterly result as I did put some comments on KLSE i3 (Search Genghis Hoe if you're interested to know what I commented).

When reading the Notes to Financial Statements of the respective quarterly reports, I sensed that the management weren't be frank with the problems that they faced and also looking for excuses on the poor financial performance:

Figure 1.0: 2Q16 Quarterly Result

Figure 2.0: 3Q16 Quarterly Result

When reading the Notes to Financial Statements of the respective quarterly reports, I sensed that the management weren't be frank with the problems that they faced and also looking for excuses on the poor financial performance:

Figure 1.0: 2Q16 Quarterly Result

|

Figure 2.0: 3Q16 Quarterly Result

Figure 4.0: 2Q19 Quarterly Result

From the above Figure 1.0 to 4.0, it's obvious that the management provided the similar reason while the financial results' release didn't meet the expectations -- why it had a major shutdown for preventive maintenance, couldn't it be avoided during the operation? I'm not sure that whether the management did highlight the 'cyclical factors' during the AGM or any interview before. Would the preventive maintenance be one of the major business risks?

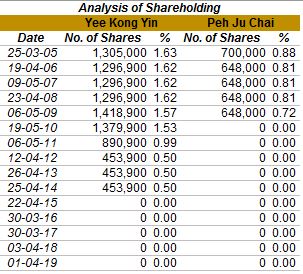

To recall, let's refer to the past 5-year Financial Highlights to assess whether the management is candid to face the issues and competent to resolve it.

From the past 5-year revenue, it's obvious that revenue FY2018 was plunged by RM 96.58 million (down by 17.74%) and net assets were squeezed by RM 16.69 million (down by 3.65%) as compared to the previous financial year. In hindsight, the management might be aware that its core business operations would be impacted by inherent risks, therefore proposed to venture into King Oyster mushroom cultivation by giving the reason that those residual wastes could be utilised to cultivate the mushroom, in order to create extra income stream in future.